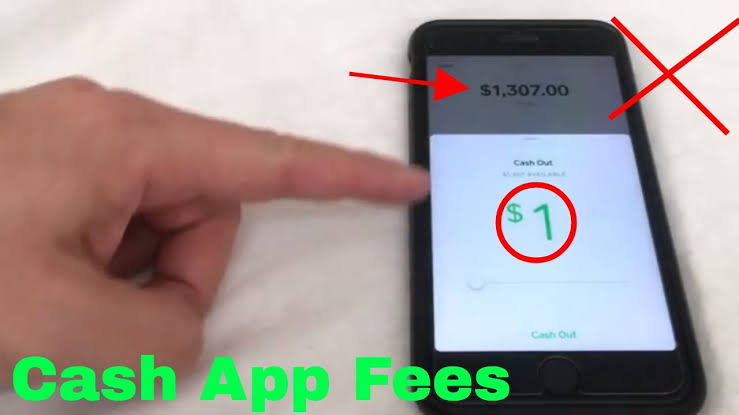

how much does cash app charge to deposit

How much does cash app take out of 800. Cash App has a transfer limit for how much you can send and how much you can receive.

/A2-DeleteCashAppAccount-annotated-5d48188372ff4dcb945d9c30f361bc4b.jpg)

How To Delete A Cash App Account

Standard deposits are free and arrive within 1-3 business days.

. So sending someone 100 will actually cost you 103. If you are sending money via a credit card linked to your Cash App a 3 fee will be added to the total. Cash App direct deposits are made available as quickly as possible once theyre sent.

Cash app charges 15 minimum 025 for each instant deposit. The default account limit on Cash App for sending money is 250 within a seven-day period. You can make use of free ATM withdrawal if you have got 300 deposited in your Cash App.

How much is Cash App fee. The fee may be higher if you use ATMs other than your own network. If you request an Instant.

Cash App charges a 3 percent fee if you use a credit card to send money but making payments with a. When sending money with a credit card Cash App charges a 3 fee while making payments using a debit card or bank account is free. The 7-day and 30-day limits are based on a rolling time frame.

By joseph June 15. There are some limits in place depending on the amount of the check and the money should be available in your account within 4 business days after depositing if you do so before 7 PM on a weekday. Cash App isnt an expensive or bank-breaking platform.

For users who receive direct deposits of at least 300 each month Cash App reimburses ATM fees including third-party ATM fees for up to three ATM withdrawals per 31-day period up to 7 in fees. Users are allowed to send up to 250 within any seven-day period and receive up to 1000 within any 30-day period according to the website. Cash App charges 2 per ATM withdrawal made with a Cash Card on top of any fees the ATM owner charges.

Cash App Direct Deposit Fees are 025 per transaction. This fee goes towards processing the transactions and paying out your funds. Instant Deposits are subject to a 15 fee but arrive on your debit card instantly.

In addition you may be charged a fee by the ATM itself for using a debit card from a different bank to withdraw money. Cash App offers standard deposits to your bank account and Instant Deposits to your linked debit card. How Much Does Cash App Charge.

The ATM withdrawal fee is 2 for Cash App. How Much are Cash App Direct Deposit Fees. The process is straightforward and Cash App does not charge any fees for check deposits.

If you successfully go through Cash Apps verification process you should be able to send up to 7500 per week and up to 17500 per month. If you receive money on Cash App and want to cash it out immediately youll pay a 15 fee for an instant deposit. In cash app instant deposits cost 15 of the total amount.

While Cash App itself doesnt mention a specific time of the day on their website it takes about 1-5 days for the funds to hit your account. You can avoid fees Up to 3 ATM withdrawals per 31 days will be reimbursed if you receive paycheck direct deposits to your Cash App account that total more than 300 per month. Standard deposits are free and arrive within 1-3 business days.

Typically Cash App ATM withdrawals charge 2. If youd want to avoid paying ATM fees with Cash App youll need to enroll in direct deposit and receive at least 300 in eligible monthly direct payments. Instant Deposits are subject to a 05 -175 fee with a minimum fee of 025 and arrive instantly to your debit card.

Cash App charges a 3 on money transfer via credit card 15 of the total amount on instant funds transfer 2 to 3 fee on cryptocurrency and 2 on per ATM withdrawal. The cash app doesnt charge a fee to send request or receive personal payments from a debit card or a bank account or for a standard deposit. The additional fee is always something users would love to go around therefore many of you must be wondering if the cash-out can be made completely free.

Furthermore there is no fee. When sending money with a credit card Cash App charges a 3 fee while making payments using a debit card or bank account is free. With Paper Money deposits you can deposit up to 1000 per rolling 7 days and 4000 per rolling 30 days.

However if youve received at least 300 in direct deposit payments into your account the. Also the funds can land in your account up to 2 days early compared to many banks. Instead most of its services are free of cost instead of a couple in which you are liable to pay the associated fee.

The Cash App weekly limit reset doesnt occur on specific days or at specific times but it should happen a. Transactions must be a minimum of 5 and cannot exceed 500 per deposit. Limits apply A max of 310 per transaction and 1000 per 7-day period can be withdrawn.

6 rows However there is a 3 fee if the funds are paid using a credit card.

Cash App Vs Venmo Which Is For You

How To Permanently Delete Your Cash App Account And Unlink It From Your Bank App Accounting Hack Free Money

Cash App Vs Venmo How They Compare Gobankingrates

Square S Cash App Tests New Feature Allowing Users To Borrow Up To 200 Techcrunch

What Does Cash App Transfer Failed Mean To Us App Support How To Get Money Coding

How To Add Bank Account To Cash App 2022 Link A Bank Account Now

Does Cash App Charge A Fee To Receive Money

How To Transfer Money From Your Cash App To Your Bank Account Gobankingrates

What Is The Cash App And How Do I Use It

Income Reporting How To Avoid Undue Taxes While Using Cash App Gobankingrates

What Does Cash Out Mean On Cash App Here S An Explanation And Simple Cash Out Method