michigan gas tax revenue

0183 per gallon. Ad Avalara solutions can help you determine energy and fuel excise tax with greater accuracy.

As Gas Prices Soar Michigan Tax Holiday Plans Prompt Squabbling Gridlock Bridge Michigan

Although directed to the Michigan Transportation Fund revenue from the Michigan gasoline tax broke 1000 million for the fifth time in the last 12 months.

. Motor fuel taxes are levied on. The state tax of 272 cents per gallon the federal tax of 184 cents per gallon and the state gas sales tax of 6 percent per gallon. If you have any questions in regards to this.

But that was based on an expected average price-per. There are three gas taxes in Michigan. The study estimates that fuel efficiency gains alone would lead to a 1 billion per year shortfall in Michigan gas tax revenue by 2050.

In Michigan the revenue from regular gasoline sales tax was projected to be 621 million in the 2022 fiscal year. The Michigan Severance Tax Act MCL 205301 levies a tax on oil and gas severed from the soil in Michigan. Michigan road agencies concerned about potential gas tax suspension We do have enough dollars that come in from other revenue -- general fund revenue -- that we.

Currently state gas taxes range from 1432 cents per gallon in Alaska to 6205 cents per gallon in California not including the 184 cents per gallon federal gas tax they. City Individual Income Tax Notice IIT Return Treatment of Unemployment Compensation City Business and Fiduciary Taxes. Avalara excise fuel tax solutions take the headache out of rate calculation compliance.

The owner of the motor fuel is required to fill out form number 4010 and remit any additional motor fuel tax that may be owed to the Department. Although directed to the Michigan Transportation Fund revenue from the Michigan gasoline tax broke 1000 million for the fifth time in the last 12 months. But that was based on an expected average price per gallon at.

Getting gas can be pricy depending on the vehicle and oil market but in Michigan drivers could be forced to shell out more at the station if a current gas tax increase proposal is. In 2020 Michigan collected 317 billion in. It is estimated that fuel efficiency gains alone would lead to a 1 billion per year shortfall in Michigan gas tax revenue by 2050.

Its important to future-proof Michigans. Michigan gas taxes averaged 456 a gallon on Thursday according to AAA and state senators say a tax savings plan would save about 50 cents a gallon. Motor fuel taxes are levied on.

Federal motor fuel taxes. Producers or purchasers are required to report the oil and gas production and the. The revenue Michigan received from its motor fuel tax in fiscal year 2018 was 226 billion of which 259 or 5879 million was diverted to the states School Aid Fund.

The current federal motor fuel tax rates are. Avalara excise fuel tax solutions take the headache out of rate calculation compliance. For transactions occurring on and after October 1 2015 an out-of-state seller may be.

Ad Avalara solutions can help you determine energy and fuel excise tax with greater accuracy. Motor Fuel - Letter of Inquiry Concerning Michigan Taxes. Streamlined Sales and Use Tax Project.

Notice of New Sales Tax Requirements for Out-of-State Sellers. 2015 PA 179 earmarked. Federal excise tax rates on various motor fuel products are as follows.

In Michigan the revenue from regular gasoline sales tax was projected to be 621 million in the states 2022 fiscal year. The revenue Michigan received from its motor fuel tax MFT in fiscal year 2018 was 226 billion of which 259 percent or 5879 million was diverted to the.

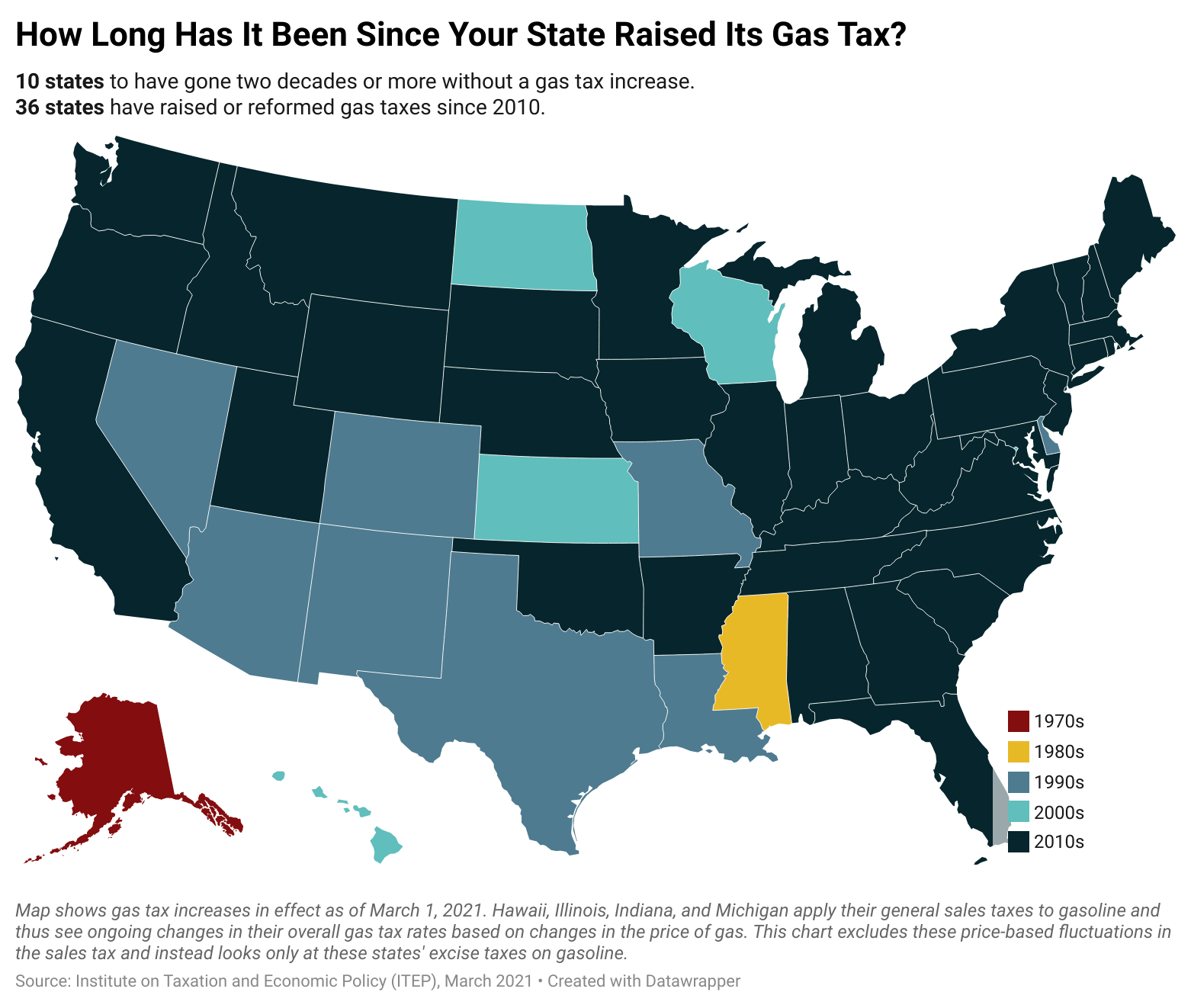

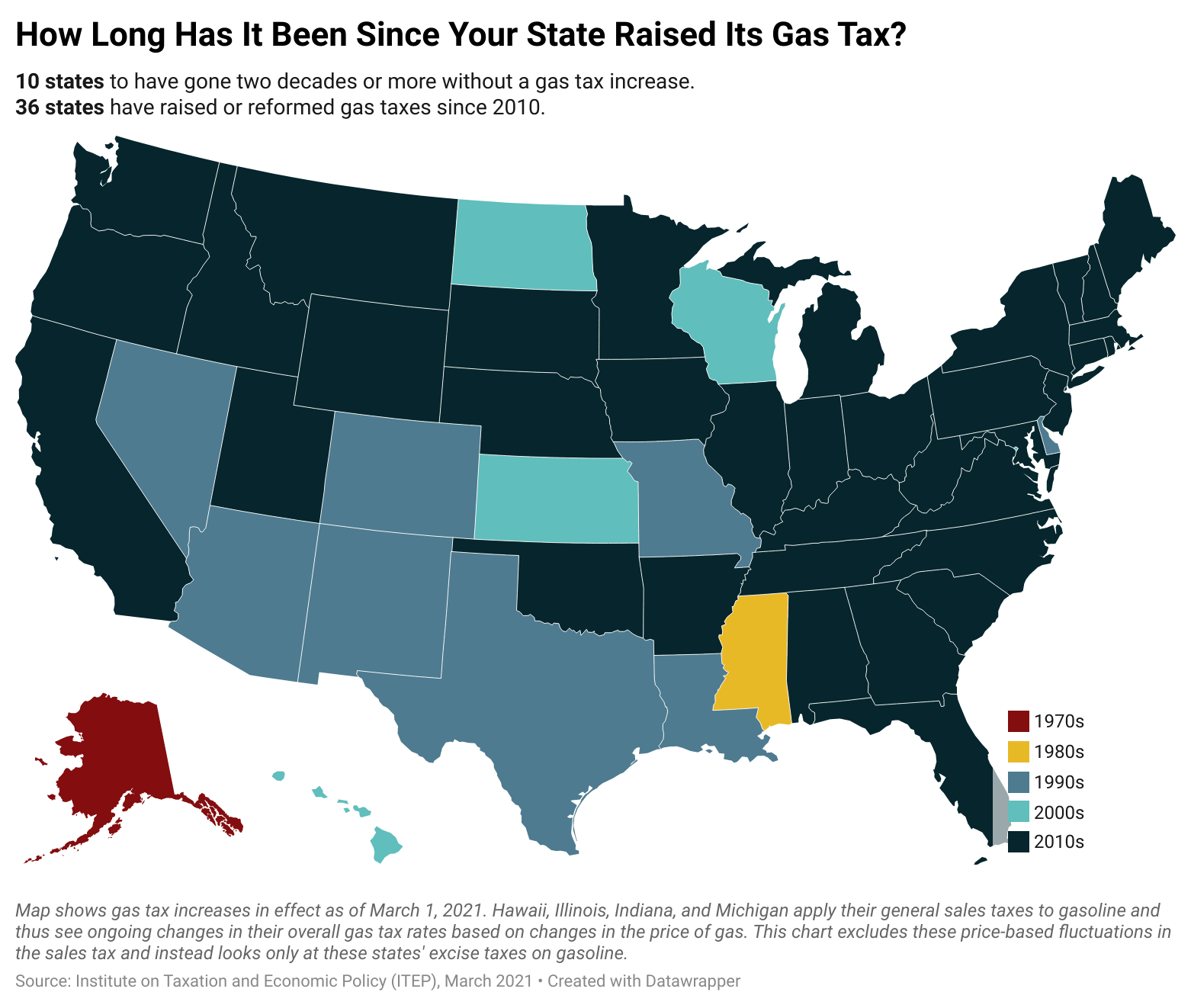

How Long Has It Been Since Your State Raised Its Gas Tax Itep

Most Americans Live In States With Variable Rate Gas Taxes Itep

/cloudfront-us-east-1.images.arcpublishing.com/gray/YNMA36INZ5PPDKP2C5SIHB7UEQ.jpg)

Aaa Michigan Gas Prices Up 16 Cents Compared To Last Week

Michigan Gas Tax Suspension Bill Could Be Headed For Veto Whitmer Indicates

The Gas Tax S Tortured History Shows How Hard It Is To Fund New Infrastructure Pbs Newshour

As Gas Prices Soar Michigan Tax Holiday Plans Prompt Squabbling Gridlock Bridge Michigan

The Federal Gas Tax Holiday Is Not A New Idea Just A Bad One Itep

Gas Prices Are Near Record Highs A Fuel Tax Holiday Could Give Consumers Some Relief Tpr

Michigan Gas Utilities Charitable Giving Wec

How Long Has It Been Since Your State Raised Its Gas Tax Itep

As Gas Prices Soar Michigan Tax Holiday Plans Prompt Squabbling Gridlock Bridge Michigan

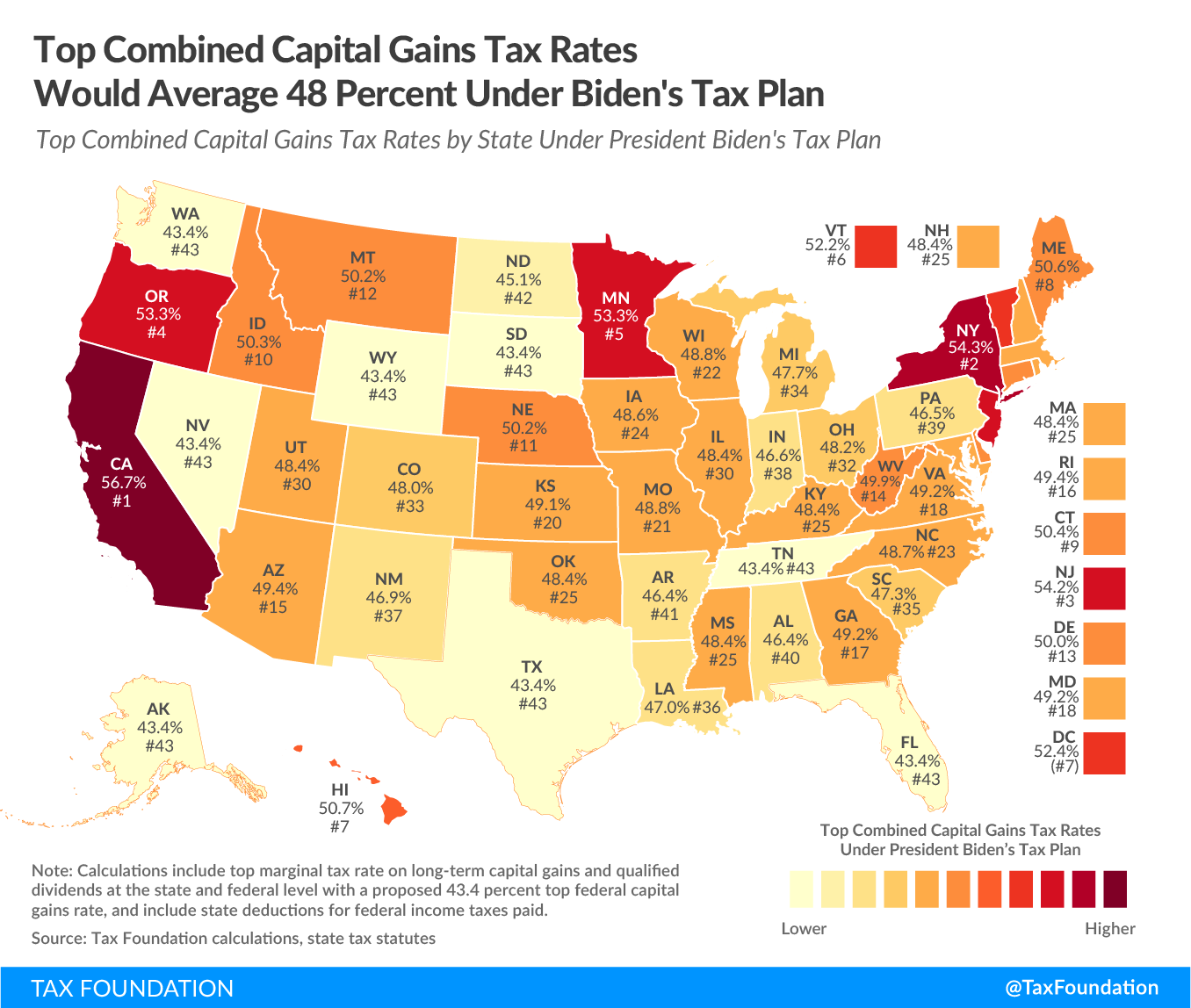

Combined Capital Gains Tax Rate In Michigan To Hit 47 7 Under Biden Plan Michigan Farm News

Biden Suspends Federal Gas Tax What S The Future Of Infrastructure Funding For Construction Pros

Motor Fuel Taxes Urban Institute

As Gas Prices Soar Michigan Tax Holiday Plans Prompt Squabbling Gridlock Bridge Michigan

Michigan Vehicle Registration Will Soon Go Up By 20

Michigan Gas Tax Suspension Bill Could Be Headed For Veto Whitmer Indicates